Charging into the Future: Europe and the United States Race to Build EV Infrastructure

The global shift towards electric vehicles (EVs) is accelerating, with both governmental incentives and the necessity for climate-friendly alternatives paving the way. This transition hinges largely on a robust, accessible charging infrastructure. Let's take a closer look at how the EV markets and charging infrastructures have evolved in the United States and Europe.

Europe and the United States, though similar in land mass at roughly 4 and 3.8 million square miles respectively, differ in population size, with Europe home to 746 million people compared to the US's 332 million. Europe, with more than 535,000 public charging points, outpaces the US in terms of established charging infrastructure. Its comprehensive network caters to both city commuters and long-distance travelers. The distribution of charging stations is proportionate to the number of EVs in different countries, with 40% of the infrastructure concentrated in Germany and the Netherlands. Norway, however, has the highest number of chargers per capita.

The European charging sector is highly competitive, with many firms operating in multiple countries. The most prominent player controls a mere 4.1% of the market, with Tesla leading in total capacity due to its network of high-wattage fast-chargers.

In contrast, the US has approximately 145,000 public charging points, unevenly distributed across states. California, New York and Florida lead with the highest number of charging stations, while colder, less populous states lag behind. The US market is dominated by three companies: Tesla, ChargePoint and EVgo. Tesla, having pioneered long-distance EV travel, planned their network for inter-state journeys, promoting EV sales and reducing range anxiety for customers.

Housing and Charging Needs

Housing styles greatly influence charging needs. In the US, where 70% of people live in single-family homes, the majority install private chargers to take advantage of low overnight electricity rates. The US Department of Energy estimates that 80% of EV charging happens at home, and 64% of EV owners have a Level 2 charger.

Across the pond, with 46% of Europeans living in apartments, installing private chargers often proves challenging due to shared spaces and metering issues. Consequently, 70% of charging in Europe occurs at home or work, with workplace charging being more significant than in the US. Nordic countries and France lead in workplace charging, with these points seeing higher usage due to multiple users.

Government Incentives

European governments have long incentivized EV infrastructure development through grants, tax credits, and funding for charging stations. Most EU countries, including Norway, fund charging stations for private individuals, apartment and condo owners, and businesses.

The US adopted a similar approach in 2022 with two pieces of legislation to boost EV charging station construction, focusing on designated Alternative Fuel Corridors and expanding charging access across the country, including rural and underserved communities.

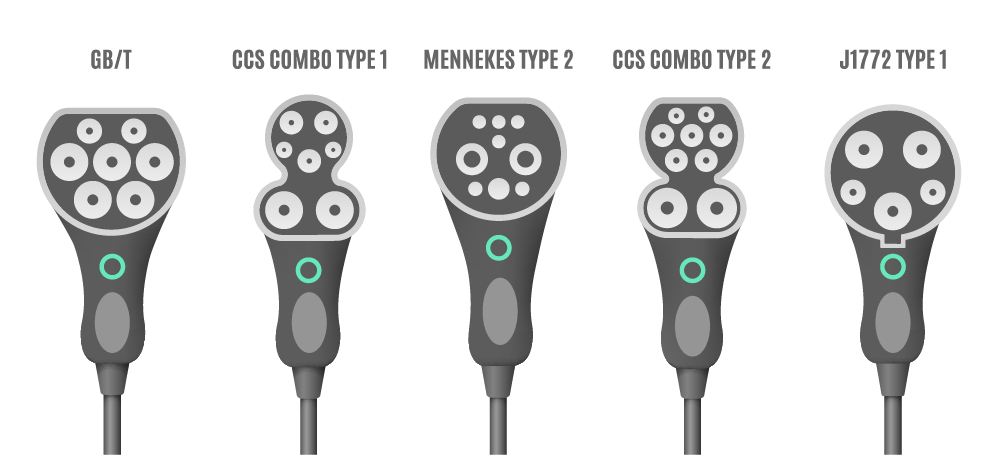

Connectors

In 2014, the EU legislated standardized connectors for public charging stations, expediting EV adoption and preventing market fragmentation. This approach was successful, despite an exemption for companies providing exclusive charging services. Tesla transitioned to European-standard connectors in 2019 and opened their network to other customers in 2022.

The US saw a more diverse evolution of connectors, with varied ports across manufacturers and charging stations. However, the 2022 legislation stimulated a shift towards standardization. Major manufacturers announced customer access to the Tesla network and adoption of the Tesla charging port. This port has now been rebranded as the North American Charging Standard (NACS), around which the market appears to be consolidating.

Future Needs

Both Europe and the US anticipate a surge in EV uptake, with some regions planning to phase out internal combustion engine cars by 2035. However, the installation of charging points has lagged behind EV sales. As waiting for an EV charge is less convenient than refueling at a gas station, an ample supply of charging stations is vital to encourage the switch to EVs.

The US Department of Energy estimates a need for over 600,000 Level 2 public and workplace chargers by 2030. This means installing more than 5,000 new charging points every month. Europe also recognizes the need for a rapid increase in charging infrastructure, with even higher estimates due to a greater reliance on public charging.

Despite the differences in their evolution, both the US and Europe are moving towards standardized charging ports to facilitate smoother EV charging experiences. As they expand their charging infrastructure, both regions must also consider upgrading power grids to ensure the generation and distribution of clean power can meet the demand. This is vital for guaranteeing reliable, affordable EV charging for all.

Power Integrations supports the electrification of transportation with highly efficient solutions for electric vehicle charging, including InnoSwitch3-AQ switcher IC families for high voltage auxiliary power supplies, as well as SCALE-iDriver high-power gate driver ICs for high-speed DC chargers.